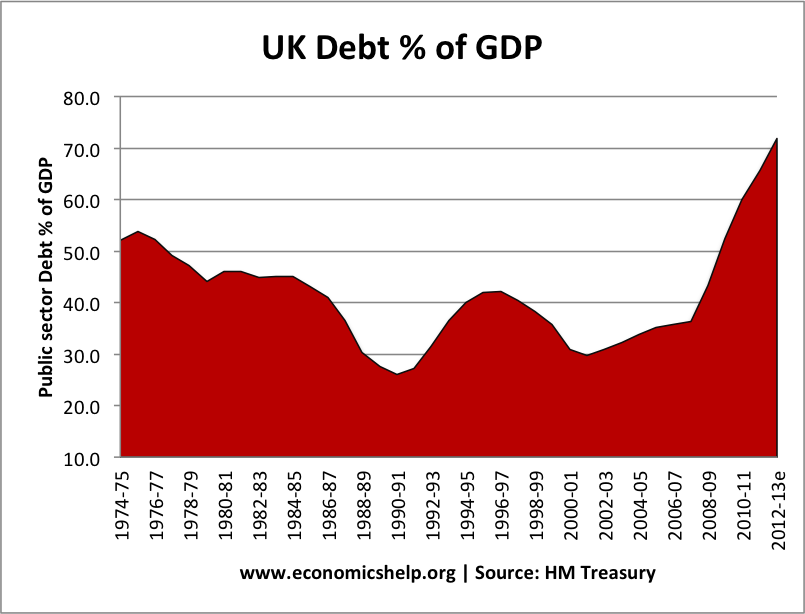

I’m fascinated by debt – or ‘credit’ as it’s known in polite circles. The UK has an eye-watering National Debt of almost £1.5 TRILLION (and rising).

I’m fascinated by debt – or ‘credit’ as it’s known in polite circles. The UK has an eye-watering National Debt of almost £1.5 TRILLION (and rising).

To mere mortals, ‘debt’ is a four-letter word – something to be eschewed on pain of the workhouse or some equally grizzly fate. There’s a whole industry in the UK that focuses on debt collection – lawyers, bailiffs and professional debt collectors who go by a number of rather fanciful ‘noms de guerre’.

At odds with this is the reality that, in business (and in the governmental fiscal arena), it’s debt that makes the world go round. Providing you have the means to service your dirty little secret – or assets you can use as ‘security’ – no-one will bat an eye-lid.

After all, financing corporate and personal debt is a nice little earner for those in the money business. Just look at the financial ‘products’ they have at their disposal – leasing, asset and invoice finance, second mortgages… the list is endless.

When the most recent credit bubble burst in 2007-8, everyone blamed everyone else and the global financial village for the crisis. The reality is, however, we’re all hooked on credit (or debt). So is it only a matter of time before new crises raise their heads?

Playing Politics

In the UK, consumer debt is currently being fueled by cheap mortgages – courtesy of government vote-winning schemes and supported by low interest rates, courtesy of the Bank of England. Employment is being bought by government investment in white elephant capital projects such as the HS2 rail folly. And business continues to bay for easier access to credit.

If the Bank of England is the ‘lender of last resort’, then the UK government (of whatever political persuasion) is surely the ‘spender’ of last resort. Never mind the budget deficit. Let’s add to the National Debt, come what may, by buying political Viagra for middle Englanders.

Politicians have no need to worry. They can obfuscate and hide the reality of the National Debt in a maelstrom of Treasury jargon. As we emerge from the longest recession since the 1930s, growing GDP will mask the reality of the UK’s economic nightmare by presenting the deficit as a falling percentage of national income.

It will take many years of budgetary surpluses to enable governments to make even the smallest inroads into our massive National Debt. Where is it all heading? Will we end up selling our sovereignty to emerging economies like China, Russia or Brazil? The US economy is already in hock to the Chinese to a worrying extent.

The Credit Paradox

Debt has consequences – depending on how it’s managed. Whether it’s government, business or personal debt, credit creates the ultimate paradox. It’s supposed to be the great enabler but all too often ends up seriously constraining the recipient.

When handled well – and where economic conditions are stable – credit can work miracles. Without 25-year mortgages, the UK wouldn’t have its so-called ‘home owning’ class. Without leasing facilities, ‘swashbuckling’ budget airlines wouldn’t have any planes – and farmers wouldn’t have their tractors.

Many a ‘zombie’ business (busy treading water throughout the recession) would probably have gone under without cash-raising devices such as invoice discounting. Peer-to-peer lending has strolled onto the sunlit uplands of profitable private lending – and we all know how ruthless payday loan companies have usurped the traditional role of banks as High Street usurers.

Will we never learn? The UK is a nation of credit junkies. Tinkering with the regulators of credit and finance; re-organising the banks’ internal structures; and massaging national economic statistics for short-term political gain won’t change our more-more-more mentality.

About the Author

Mike Beeson is a highly experienced UK journalist, financial copywriter and PR consultant. Mike’s company, Buzzwords Limited, was established over 20 years ago and is located in Knutsford, Cheshire (south Manchester).